Smart Tips to Enhance Your Credit Score

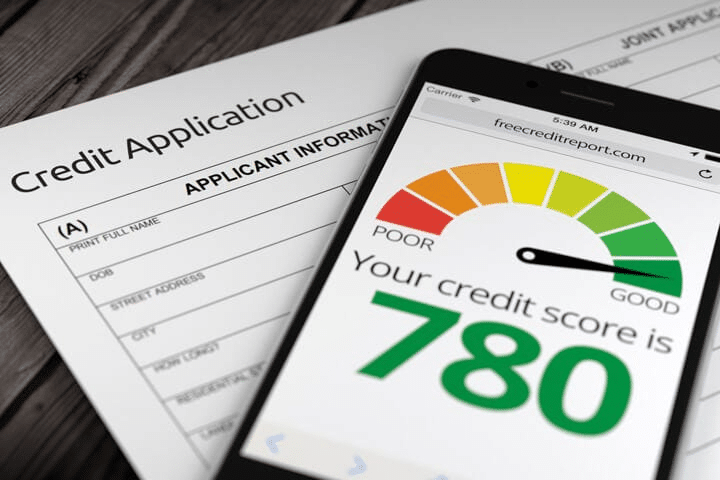

Have you thought about how your credit score affects your finances? Whether you’re aiming for a loan, buying on credit, or seeking better interest rates, a strong score can unlock numerous opportunities.

No need to stress about boosting your score. Simple, actionable steps in your daily life can lead to improvements. In this post, we’ll provide useful tips to help you enhance your credit standing. Ready to dive in?

Ways to Elevate Your Credit Score

If you’ve faced difficulties obtaining credit cards or loans, you understand how crucial it is to maintain a solid credit score.

The great news is that boosting your score is easier than you might think! By adopting a few straightforward changes in your financial habits, you can increase your score and enjoy more freedom in achieving your aspirations.

1. Timely Bill Payments

This might seem basic, yet countless individuals still miss bill payments, negatively affecting their credit scores. Even minor delays can lead to a drop in your score.

Credit agencies track your payment history, which plays a role in determining your score. So don’t delay—handle payments promptly!

Consider setting reminders on your phone or automating bill payments to ensure you never miss a deadline, thus keeping your score healthy.

2. Manage Spending and Avoid Credit Card Debt

Credit cards are a popular credit option, and using them wisely can significantly boost your score. Aim to keep your usage below 30% of your credit limit.

Exceeding this limit can hurt your score, as it suggests possible debt issues. Also, refrain from paying just the minimum amount; while it may ease your finances temporarily, it accrues interest and can harm your financial health long-term.

3. Settle Any Outstanding Debts

Clearing any debts you owe is one of the most crucial steps to enhancing your credit score.

Paying off your debts not only lessens their adverse effects on your credit score but also helps you rebuild trust with lenders.

If your debt is substantial, consider negotiating a payment plan with your creditor. Often, you can secure better terms to pay off your debt in installments and shield your score from further decline.

4. Build a longer credit history

Your credit score considers how long you’ve been associated with financial institutions.

Maintaining accounts or credit cards responsibly over time can significantly boost your score, as lenders view long-term customers as more reliable.

When opening new accounts or applying for credit cards, proceed with caution. Opening multiple accounts quickly can lower your score, signaling instability.

5. Leverage your positive record

A strong credit history allows lenders to see your good payment habits alongside any debts. Timely bill payments can enhance your credit score.

Being on the positive register is a fantastic opportunity for those with a solid payment history but a low score. Make sure you’re registered to showcase your commitment to timely payments.

6. Regularly check your score

Keeping tabs on your credit score is vital to assess if your strategies are effective.

Many services provide free credit score checks, helping you understand your progress and stay on track.

Keep a close eye on your score to see what’s working well and what might need some tweaking.

7. Cultivate patience and consistency

Improving your credit score takes time. The secret to achieving your goals lies in being patient and consistent.

Your credit score can improve over time. By consistently paying your bills, managing your spending, and clearing debts, you’ll notice a positive change. Just remember, taking that first step is key to advancing your financial journey.

Boosting your credit score might seem daunting, but with some helpful strategies, you can raise your score and pave the way for a more secure financial future.

By adjusting your financial habits—like timely bill payments, prudent credit card use, and settling any debts—you’ll be headed in the right direction.

Ultimately, remember that keeping a solid credit score demands commitment and consistency, but the rewards are great. Start now and reap the benefits of a strong financial background!