How Digital Wallets Transform Payments

Over the years, our approach to handling money has significantly changed, with digital wallets leading this evolution.

As technology progresses, physical cash and traditional banking practices are slowly being replaced by more streamlined, secure, and accessible payment methods.

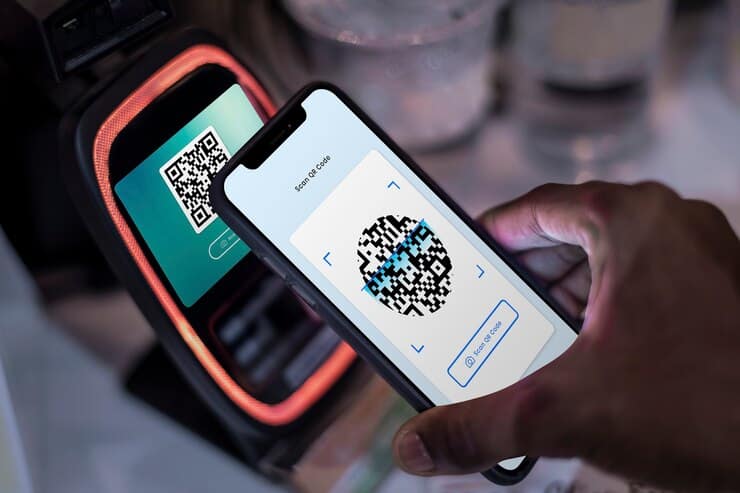

Digital wallets enable users to electronically keep payment details and conduct transactions effortlessly with a mere tap or click.

From daily small purchases to substantial financial dealings, they are transforming the global market landscape.

The growing popularity of digital wallets stems from the rising need for convenience, security, and financial accessibility.

Whether it’s buying groceries, transferring money to friends, or handling subscriptions, digital wallets have become vital in our modern financial routines.

But what drives their swift expansion, and what does the future hold for this technology? Let’s delve into the elements propelling their growth and their influence on how we manage money.

The Rise of Digital Wallets

Digital wallets have surged in popularity thanks to their user-friendly nature and broad availability.

With smartphones and internet access becoming ubiquitous, countless individuals now depend on digital wallets for everyday transactions. Services like Apple Pay, Google Wallet, PayPal, and regional options like WeChat Pay and Paytm have transformed payments, removing the necessity for cash or cards.

Several key factors are driving this increase in usage:

- Quick and Easy: Digital wallets let users make transactions in seconds, whether online or offline. Features like contactless payments and QR scanning make it even easier.

- Improved Security: Top-notch encryption and biometric verification lower the chances of fraud and unauthorized access, making digital wallets a safer choice compared to traditional cash or cards.

- Wider Access: Mobile wallets open doors for many who previously lacked access to traditional banking services, allowing them to engage in the financial ecosystem.

- Versatile Functions: Digital wallets do more than just process payments. They can store loyalty cards, transit passes, and even cryptocurrencies, making them highly functional.

Digital Wallets and Changing Spending Habits

The growing dependence on digital wallets has transformed how consumers spend their money.

As more individuals adopt cashless methods, businesses are responding by incorporating digital payment solutions.

From retailers to online shops and street vendors, digital transactions are becoming commonplace, appealing to a growing audience that values the speed and ease of mobile payments.

Moreover, digital wallets are fueling the rise of subscription services, allowing users to automate payments for streaming services, food deliveries, and cloud storage, ensuring seamless access to their favorites.

The Impact of Digital Wallets on the Global Economy

Digital wallets are not only transforming individual user experiences but also influencing economies around the globe.

They facilitate international transactions with low fees, improving the efficiency of trade and remittances. In areas with limited banking access, digital wallets become vital financial instruments, empowering small businesses and individuals to engage in the digital marketplace.

Authorities and financial institutions are increasingly acknowledging the promise of digital wallets.

Some nations are working on central bank digital currencies (CBDCs) that could be integrated with current digital wallet platforms, making monetary transactions even smoother.

Obstacles and Future Prospects for Digital Wallets

Despite their advantages, digital wallets come with their own set of challenges:

- Cybersecurity Risks: With the rise of digital transactions, threats like hacking and identity theft are also increasing. Ongoing advancements in security measures are crucial.

- Regulatory Issues: Regulatory frameworks must be developed by governments and financial entities to combat fraud and protect consumers.

- Adoption Barriers: Many remain reluctant to switch to digital wallets due to a lack of knowledge or tech skills.

Looking forward, digital wallets are expected to merge with new technologies like artificial intelligence and blockchain, boosting both effectiveness and security.

Advancements in 5G and Internet of Things (IoT) technology may further enhance payment processes, making digital wallets an even more essential part of our everyday routines.

Conclusion

The emergence of digital wallets signifies a major change in the financial world. They provide ease, security, and accessibility, simplifying transactions for both individuals and businesses.

With ongoing technological advancements, digital wallets are set to remain vital in the evolution of payments and promoting financial inclusion.

For both consumers and business owners, adopting this innovation opens doors to exciting possibilities in the fast-changing digital economy.